Changes Coming To Macy’s In The Railway Exchange

Macy’s currently occupies the first six floors of the 21-story Railway Exchange Building.

The department store plans to consolidate into the lower three floors. Â Macy’s contains two restaurants, Papa Fabares on the 2nd floor and The St. Louis Room on the 6th, but you need to know about them because you won’t find any information on their website:

The store is still listed as “St. Louis Centre” for the former mall to the north being rebuilt as a parking garage with street-level retail.

Papa Fabares takes you back in time and the French Onion Soup is the signature item. Â I don’t see this restaurant going anywhere when Macy’s consolidates.

The 6th Floor St. Louis Room, however, will be a casualty since this floor will no longer be a part of Macy’s.

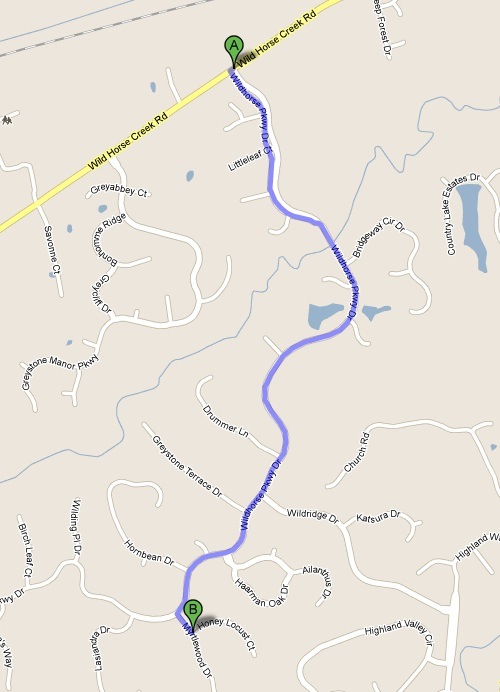

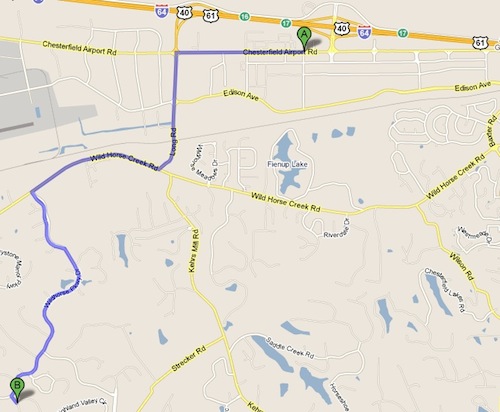

I’m unsure what will happen to the pedestrian walkway over Olive to the parking garage. Â Most months when I go to a regular lunch meeting at the St. Louis Room I just use my wheelchair to travel the 10 blocks to the store, but a few times I will drive my car and then the pedestrian bridge is handy in bad weather.

The pedestrian bridge connects at the 4th floor of the Railway Exchange Building, one above Macy’s after consolidation. Â It is butt ugly and should go but the sidewalk level disabled entrance faces 6th Street, not Olive. Â Removing the bridge might present some ADA access issues. Â I’m torn, the urbanist in me says the bridge needs to go but the disabled me says it is handy.

– Steve Patterson