Local Elections In Missouri Tomorrow: 2 Propositions For City Voters, 4 Propositions For County Voters

Voters in Missouri will be going to the polls tomorrow, unless they voted absentee as I did. The post will cover St. Louis city & St. Louis County. For voters in Jefferson & St. Charles counties click here or here, respectively.

The ballots in the city are identical, and short. Only two propositions.

PROPOSITION R (Proposed by Initiative Petition [the full text of which is available at all polling places])

Shall Article IV of the City of St. Louis Charter be amended to:

- Prohibit Aldermen from taking actions on matters pending before the Board of Aldermen where they have a personal or financial conflict of interest;

- Require that Aldermen’s financial disclosure statements be open to the public;

- Have ward boundary maps drawn by an independent citizens commission after each decennial census; and

- Prohibit the Board of Aldermen from changing voter-enacted voting methods for municipal offices without first submitting such changes to the voters?

YES – FOR THE PROPOSITION NO – AGAINST THE PROPOSITION

PROPOSITION 1 OFFICIAL BALLOT – BOND ELECTION

Shall the following be adopted:

Proposition to issue bonds of The City of St. Louis, Missouri in an amount not to exceed Fifty Million Dollars ($50,000,000) for all or a portion of the following purposes: (1) improving, resurfacing, repaving and/or repairing streets; (2) designing and constructing public safety facilities; (3) designing and constructing pedestrian and bicycle transportation facilities; (4) maintaining and improving the safety and security of correctional facilities and improving public safety systems; (5) providing local matching share funds, where applicable and necessary, to utilize federal funds in furtherance of any of the cited projects herein; (6) replacing, improving, renovating and maintaining buildings, bridges, and equipment of the City of St. Louis, such as neighborhood recreation centers and firehouses; and (7) paying for expenses associated with the issuance of such bonds. If this proposition is approved, the property tax levy is estimated to remain unchanged.

YES – FOR THE PROPOSITION NO – AGAINST THE PROPOSITION

I favor both propositions.

Campaigns for both:

St. Louis County voters will have different offices/issues on their ballots based on their address, but all will have the same four county-wide propositions. A simple majority is needed for each to pass.

PROPOSITION A

Shall the Charter of St. Louis County be amended to require that all costs associated with employees appointed by the County Executive be covered under the County Executives budget and to eliminate the authority of department heads to employ one executive assistant and one secretary for each of them outside of the merit system, as set forth in Exhibit A of Ordinance No. 28,307, on file with the St. Louis County Administrative Director and the St. Louis County Board of Election Commissioners?

YES NO

PROPOSITION B

Shall the Charter of St. Louis County be amended to change the requirements for the position of county executive so that the county executive shall hold no other employment nor shall the county executive perform work as an independent contractor during the term of office and that a violation of either of these restrictions shall cause the county executive to forfeit the office and the office shall be declared vacant as set forth in Exhibit A of Ordinance No. 28,308, on file with the St. Louis County Administrative Director and the St. Louis County Board of Election Commissioners?

YES NO

PROPOSITION C

Shall St. Louis County impose a local use tax at the same rate as the total local sales tax rate, provided that if the local sales tax rate is reduced or raised by voter approval, the local use tax rate shall also be reduced or raised by the same action?

YES NO

PROPOSITION D

Shall St. Louis County be authorized to enter into a lease agreement with Raintree Foundation for a building and surrounding ground located in Queeny Park for the operation of a pre-primary and primary grade school pursuant to the terms as set forth in Exhibit A of Ordinance No. 28,324, on file with the St. Louis County Administrative Director and the St. Louis County Board of Election Commissioners?

YES NO

For more information on St. Louis County elections/ballots check out the St. Louis County Board of Elections.

If you are a registered voter in Missouri please be sure to vote tomorrow.

— Steve Patterson

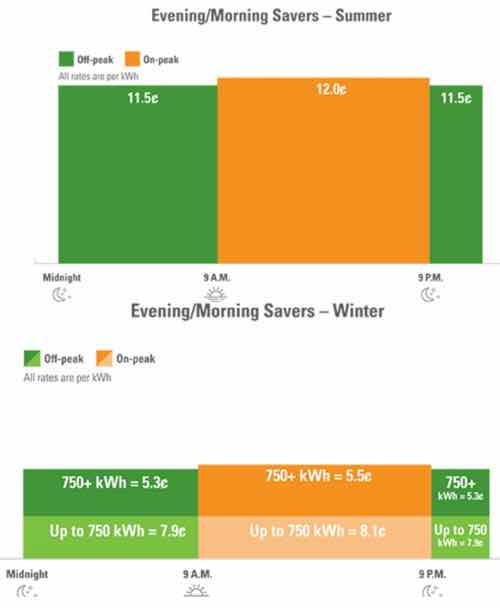

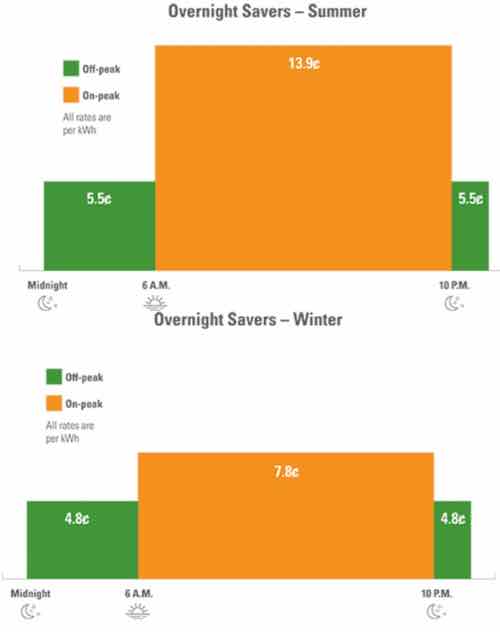

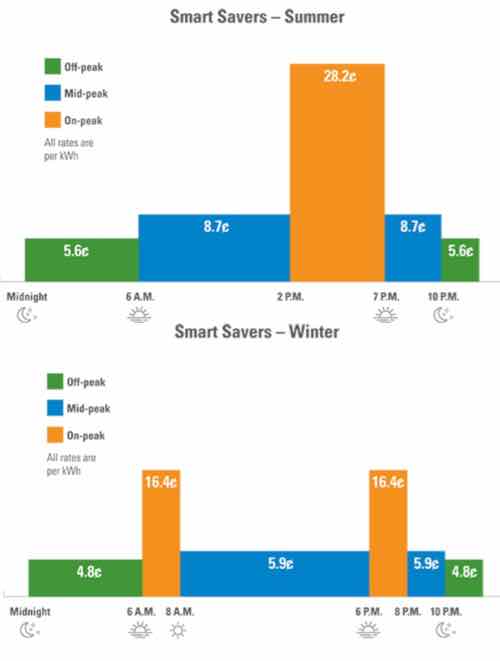

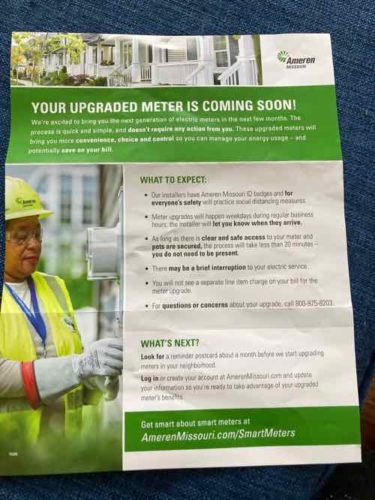

Recently we received a flyer from electric utility Ameren Missouri notifying us that our meter will be changed to a smart meter within the coming months.

Recently we received a flyer from electric utility Ameren Missouri notifying us that our meter will be changed to a smart meter within the coming months.