Why I’ll Be Voting Against the Sales Tax Increase in November

In November Missouri voters will be asked to raised the state sales tax by three-fouths of a cent, earmarked for transportation projects:

The tax increase would generate an estimated $534 million a year, with 90 percent of the money going to state projects and 10 percent to local projects. It would run for 10 years.

Critics say sales taxes are hardest on low-income people because a higher percentage of their income goes toward buying essential items. However, the 3 percent general fund portion of the current state sales tax of 4.225 percent is not applied to groceries or prescription drugs, and the increase would not be, either. (stltoday: Voters will decide whether to boost Missouri sales tax for highways, transportation)

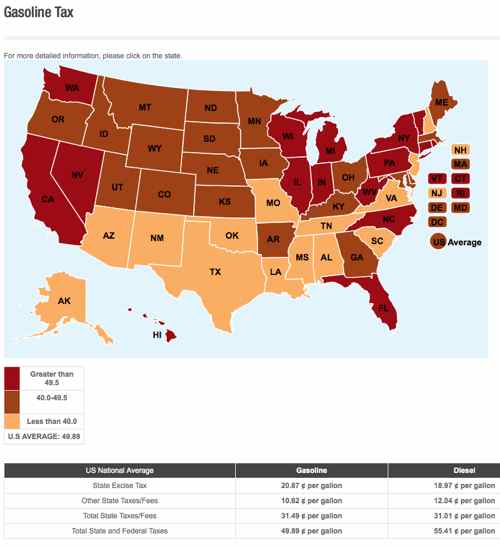

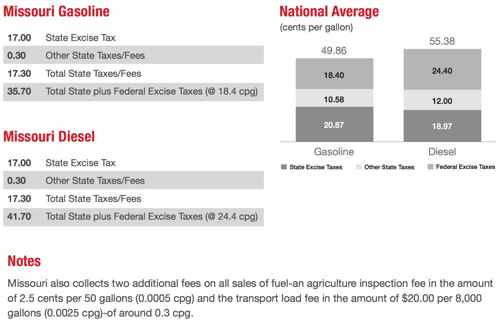

Missouri’s current fuel taxes are below the national average, and the legislature squashed Gov Nixon’s veto of a state income tax cut measure.

In five annual steps beginning in 2017, the bill will cut the state’s top personal income tax rate to 5.5 percent from 6 percent and provide a new 25 percent deduction for business income reported on individual returns.

The cuts will be implemented only if state general revenue grows by at least $150 million a year compared with the high-water mark of the previous three years. (stltoday – Missouri Legislature overrides Nixon’s tax cut veto)

Back to our low fuel taxes:

All over the state roads & bridges are crumbling, and I’m a huge fan of investing in infrastructure. So why am I voting no? Simple, the money has to come from somewhere, but sales taxes on necessities (groceries, clothing) is the worst way to fund transportation. The better option is to start by increasing our very low gas & diesel tax:

The gasoline tax has a lot of virtues from an economic point of view. It matches costs and benefits, because drivers who buy the most fuel are also causing the most wear on our roads. It’s easy to collect and hard to evade.

The fuel tax tends to be unpopular with the trucking industry, which would rather have the rest of us pay for the infrastructure that it uses most intensively. And trucking lobbyists tend to have a lot of clout in state capitols, which may be why the Legislature is talking about raising the sales tax instead of the gasoline tax. (stltoday: Sales tax is wrong way to pay for Missouri roads)

What about Oklahoma, why is their gas tax is 3 cents less per gallon? We should do what they do to keep from raising our fuel taxes, you might say. Fine by me!

Oklahoma has 10 turnpikes, more than 600 miles of pavement, making the state second in the nation for miles of toll roads. (Oklahoma Doesn’t Make Profit On Turnpikes; Who Does?)

Tolls, like fuel taxes, makes those who use the infrastructure pay for the infrastructure. I’ve paid more to Oklahoma in tolls than in fuel taxes the last 23+ years of driving back to visit family.

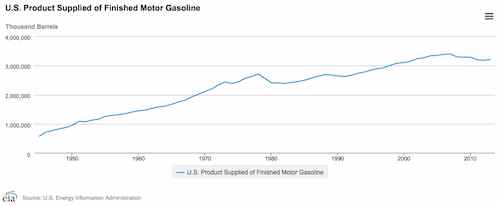

A common misconception is more fuel efficient cars, hybrids, & electric vehicles have significantly reduced revenues collected from fuel taxes. It’s true, cars are more efficient:

Cars and light trucks sold in the United States hit a new record for fuel efficiency last year — 23.6 miles per gallon, on average — in response to still-high oil prices and strict new fuel-economy standards.

That’s a big step up from the 22.4 miles per gallon average for new vehicles in 2011. And overall fuel economy is expected to increase to 24 miles per gallon in 2013, another record. (Washington Post: Cars in the U.S. are more fuel-efficient than ever. Here’s how it happened.)

But that’s not why fuel taxes don’t cover needed work, just look at the federal highway trust fund:

The Fund is paid for by the federal gas tax. The gas tax has not been raised in over twenty years. Many items have doubled or tripled their cost since 1993. For example, a new car cost $12,750 in 1993, yet in 2013 a new car cost $31,252. The easiest explanation is that we are trying to build a 2014 infrastructure system with 1993 dollars. This is obviously an untenable formula. (Highway Trust Fund 101: What You Need to Know)

Yes, the cost to build & maintain our infrastructure have been increasing while the Missouri & federal rate has remained flat. For years inflation was masked because gasoline sales and total vehicle miles driven increased year over year, the funds grew too.

Rising costs and a slight drop in gallons of fuel purchased doesn’t mean we should now start taxing every purchase to maintain roads & bridges. But yes, the number of hybrids and others has increased, but the percentage is small relative to the big picture:

The number of alternative-energy vehicles on the road grew to almost 3.1 million in 2013, compared with 2.5 million in 2012, according to the study. In 2013, nearly 72,000 vehicles were pure electrics and three million were hybrids, compared with 21,000 pure electrics and 2.5 million hybrids in 2012.

Data for the analysis comes from Experian Automotive’s database, which includes information on nearly 700 million vehicles in operation. (New York Times – Experian Study Highlights Differences Between Hybrid and E.V. Owners). I encourage you to contact your elected officials in Jefferson City and Washington D.C to tell them to increase the fuel taxes, not the sales taxes on goods. In November, please vote no on this sales take hike.

— Steve Patterson

I agree with you, completely. The last time the fuel tax was increased in Missouri, by 2 cents a gallon, was in 1996, when gas was $1.25 a gallon. Going 18 years with no change, while the cost of the product increased by more that 2.5 times, makes no sense. Do what we did in 1992 and increase the tax by a penny a gallon a year over a 6 or 8 year period and NOBODY will notice it, while our transportation system will get the funding we need. http://www.modot.org/about/funding/fundinghistory.htm

There are two parts to our highway funding needs, sprawl/congestion and infrastructure wearing out. Bridges have a design life of 50 or 60 years and eventually wear out. Heavy trucks do way more damage than lightweight hybrid cars and motorcycles to bridges and pavement, should contribute more to this part of the equation, and do so with a combination of low mpg’s and higher taxes on diesel fuel. Sprawl/congestion creates a different, ongoing demand for more lane miles, simply from the exponentially increasing number of vehicles, big and small, efficient and inefficient and the vehicle miles driven. The real question/challenge is how to best pay for suburban growth? Should urban dwellers and rural residents pay for the new highways that places like St. Charles County need? Or should the conversions of highways 40, 94, 364 and N from two-lane farm roads to multi-lane freeways actually be funded through a combination of toll roads and impact fees on new developments? We didn’t need to build a new bridge over the Mississippi for the truckers traveling I-70 all day, every day, we needed to build a new bridge so the increasing number of commuters from Illinois could get to their jobs in Missouri every day during rush hour!

I agree with you completely, but just want to emphasize how much more damage trucks do than cars.

The typical response to that argument is that “trucks pay for more fuel so it evens out.” But it’s not even close.

A single heavy truck going down a road can cause the same amount of wear and tear as – not two cars, or three, or ten, or a hundred – but literally a thousand cars or more.

The ‘fourth power rule’ is a generally accepted gauge of damage done by weight. An easily digestible summary is here:

http://thatmansscope.blogspot.com/2009/10/trucks-and-fourth-power-rule.html

A fuel tax would be better than a sales tax, but trucks really need to pay way, way more than they do. It’s sad that the trucking industry has poisoned the idea of a linear fuel tax that is still way too lenient on them.

Partly agree, but with semi’s now getting close to 3.5 mpg and many regular cars getting over 30 mpg, semi’s are still buying way more fuel and paying way more in taxes than you or I do. We have two distinct issues in play here, should everyone pay more in taxes to fund our transportation infrastructure? And, should trucks pay even more because they do more damage? In a perfect world, the answers to both would be a resounding yes, but we don’t live in a perfect world. If I had to pick between fighting the trucking lobby or convincing all voters to support a tax increase, I’d want to go to everyone first. The real challenge with increasing taxes on interstate trucks is that they have fuel tanks with enough capacity to get them to the most affordable state to fill up. Sure, we could tack another $1 a gallon on diesel, but we’d see instate sales fall off precipitously, no different than seeing Illinois drivers filling up in Missouri, to save 20 cents a gallon, or more, on gasoline.

Steve, the gas tax in Oklahoma is only 0.3 cents a gallon less than Missouri’s (17.0 cents vs. 17.3 cents), not 30 cents. Thanks for linking to my column.

D’oh, thanks for the correction. I’ve edited the post.

Steve, this .75% sales tax would exempt groceries and medicine. Also the money raised from it can and will be used for ALL modes, like bike/ped, aviation, transit ect and not just highways and bridges, whereas the gas tax CAN ONLY be used for highways and bridges.

As long as rural politicians are involved, the lion’s share of any “transportation” taxes will continue to be dedicated to highways. And while I’d love to see more state funding coming into Metro, if they can’t convince local taxpayers to support them, why should they expect taxpayers in the rest of the state to do so?!

Worth noting that you mention taxing essentials such as groceries as not being a fair way to pay for transportation, but your very first quote notes that the current general fund sales tax as well as this increase does not apply to this increase. I still agree with you, but just something you might want to address/remove from your argument.

Also, in regards to an increased gas tax potentially becoming less affective due to less miles traveled and more fuel efficient vehicles—that’s a good thing! There are two very good reasons to raise the gas tax. One is to raise more money for maintaining our infrastructure (which as you note it still would do). The other is to discourage people from being as dependent on gas (both for economic and environmental reasons). Whether that’s through less driving or more fuel efficient cars, it’s progress.

It’s not different than a heavy cigarette tax. You do it to raise money, but you also do it with the hope that it ultimately encourages people to kick a nasty habit because it’s expensive.

So if an increased gas tax ends up not raising a penny because suddenly everyone starts taking alternative transit and/or driving around in electric cars in hybrids, well that may be a bummer for our budget, but it’s a great deal of progress for our quality of life and environment.

Raising the gas tax would be an absolute win-win.

I’m opposed to raising sales tax to pay for roads. I can appreciate the potential use for other “infrastructure”, but when there are so many miles of road and bridges in disrepair, these other means of transportation will need to be funded in other ways. I’m wondering if another option would be to tax automobile registration or add on fees specific to automobile registration or sales.

Justin that’s already done. Car tax already goes to modot. Between car tax, car sales tax and registrations it’s about $800 million a year.