Cash, Jack, Square, St. Louis and life in cities

As I’ve written before, how we live in cities changes because of technology. The streetcar allowed cities to physically grow outward and the automobile took cities further and further outward. The mobile phone has allowed us to be away from a land line. The phone booth has disappeared. The notebook and wi-fi has moved the office to the corner coffeehouse.

Cities exist as a place to exchange goods and services. St. Louis, for example, started in 1764 as a place to trade fur. Currency is exchanged for goods and services. In St. Louis that currency has been Spanish, French and American. The bills and coins have changed since the mid 18th Century.

Today we often use a debit or credit card rather than cash. I have coins for the purposes of feeding our 20th century parking meters. Newer vending machines often take plastic. Cash is on the way out with other paper items, like newspapers.

Enter Jack. St. Louis native and founder of Twitter, Jack Dorsey. Jack hates cash so he started Square to allow people to easily accept plastic with their mobile phone, initially the iPhone (and iPod Touch). The national press covered the start-up announcement last week.

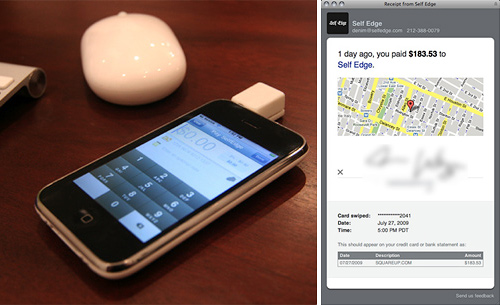

According to Square’s website, payees can start accepting payments via Square in under 60 seconds, with “no contracts, monthly fees, or hidden costs.” The company donates one cent from every transaction to the charity of the payer’s choice. In order to streamline the process, payees can register for Square and upload a photo, so that payees can verify that you are who you say you are.

It’s not yet clear how Square’s transaction fees will square with those of traditional merchant accounts. “We’re not giving out rate sheets just yet, as they are in flux until we have a general launch,” Dorsey told wired.com via e-mail. “When we do though, the fees will be completely transparent, simple and upfront.”

In order to accept credit card payment using Square’s iPhone app, a merchant attaches a card-reading dongle to the smartphone’s audio input – or “any device with an audio input jack.” Once the customer signs the phone with their finger, the transaction is complete, after which the app can e-mail a receipt to the customer. (Full story: Wired)

The initial debut is limited at first but it will open up in 2010. Articles mention two of the three cities that have vendors using the new system: San Francisco and New York. Sure, lots of new technology comes from these cities. But what about that third city where this new cutting edge technology is available? Seattle? Nope. Denver? Chicago? Getting warmer. Try St. Louis:

Dorsey partnered with Jim McKelvey, president of Mira Digital Publishing and founder of Third Degree Glass Factory in St. Louis, on the new San Francisco-based company, which also has offices in St. Louis and New York.

Dorsey, 32 is chief executive of the new company, which has rolled out service at select locations, including Third Degree Glass Factory in St. Louis and other businesses in San Francisco and New York, McKelvey said. The company plans to introduce the service to everyone in early 2010, according to a statement on its Web site, squareup.com, which lists 11 staff members. McKelvey said it wasn’t yet known how many local employees the company would have.

The inspiration for Square came in February, when McKelvey could not sell a piece of his glass art to a customer in Panama because he couldn’t take her American Express credit card for payment. “I was complaining to my friend, Jack, about this,” McKelvey said. “It should have been possible but wasn’t.” (Full story: St. Louis Business Journal)

Square will change retailing, cities and the business of exchanging money. PayPal was started by eBay as a way to facilitate payment of auction items but now PayPal represents a big portion of eBay’s total revenues. Revenues are measured in billions, not millions. Google has Google Checkout. Apple licenses a technology from Amazon to process millions of small micro-payments.

The traditional brick and mortar retailer has been stuck with with a card reader connected to a land line, if they could justify the fees. For the street vendor, farmer at a farmers’ market, artist at a street fair or others seeking payment Square will be a huge.

The mobile app is expected to sell for 99¢, the dongle will be free. The fee rate will be very straightforward. This will permit those people who do business away from a card reader they will be able to accept plastic.

I think that this is truly disruptive. The reason Square exists is because of three macro trends: the pervasiveness of the mobile Internet, the increase in the use of electronic payment systems and most importantly, the availability of low-cost, always-on computers (aka smartphones) that allow sophisticated software to conduct complex tasks on the go.

The marriage of computing and connectivity without the shackles of being tethered to a location is one of the biggest disruptive forces of modern times. It is (and will continue) to redefine business models, for decades. Square is simply riding these waves.

There is no denying that the challenges facing Square are many. But the simplicity of the idea, the audacity of the company’s dream and the convergence of diverse technology trends make Square a company to watch. (Full commentary: Gigaom)

The changes won’t be apparent in say April 2010. By April 2020? Yes. Business licenses are typically linked to a physical address, a place of business. As technology changes the address the Secretary of State keeps on file may just be where your business receives snail mail. Actual transactions may take place miles away from that address.

Retail stores are not going to go away. In fact technology such as this could help retailers have more than one point-of-sale location — such as one facing the urban sidewalk out front and one facing a rear parking lot entrance. Apple is using a new system in their stores that includes bar code reader and other features for large volume sales.

Yesterday VeriFone decided it needed to provide a mobile option for it’s service:

The PAYware app and device, which plugs into the iPod dock connector and cradles the phone, is free when users sign a two-year contract.

Along the lines of a cellphone contract, users pay an activation fee of $49, a monthly fee of $15 and 17 cents on each transaction.

The subscription model makes it an unrealistic option for the casual Craigslist seller, which Dorsey pegged as his target market. Indeed, VeriFone is going after cafes (as is Square), home repair and door-to-door salespeople. (Source: Los Angeles Times)

Unlike Square, the Verifone solution is specific to the iPhone and iPod Touch. Mobile credit/debit card acceptance will be huge.

– Steve Patterson

Square is not the first product to enter the iPhone mobile payments market. There have been a number of companies making credit card processing Apps since the spring and summer of 2009.

For the last few months I have been using iSwipe by AppNinjas. This is the website:

http://appninjas.com/iswipe/

It's a great App that has a lot of the same functionality as Square – you can e-mail receipts, it has signature capture, etc. It's worked really well for me.

Square is the first to originate sorta out of St. Louis. I like that the three cities where beta testing is being done is New York City, San Francisco and St. Louis. Good company.

And there are already many hand-held credit card readers available for street vendors that can be used off-line and later batch uploaded via phone line. The Square is nifty, though.

Yes those have been around for years, but the problem with these that Square solves is not having to have a merchant account to process payments and not having to invest in an expensive one trick pony hardware (mobile payment machines cost nearly $1000).

PayPal was started by eBay as a way to facilitate payment of auction items

Actually, it wasn't. One of the two companies that became PayPal was started in the late 90s as a mobile payment solution for PalmPilots. You could “beam” a friend money to settle IOU's. eBay never came into play until they acquired PayPal in 2002.

I don't pay anyone with PayPal, because PayPal sellers don't have their own merchant accounts and it introduces a layer of trouble if you should ever have a dispute. I have heard of all too many people who have been burned in that regard — dispute your credit card charge with PayPal, and PayPal will come after you. For the same reason, you couldn't pay me to give my credit card to a Square seller.